Peaceful ambience … These are attributes consumers place a high value on today – and Lucid Motors knocks all of them out of the park.

Lucid designed its car with this post-luxury vibe in mind. The company is positioning itself as a so-called “ post-luxury” brand that focuses on elegance and modernity over the traditional legacy focus-points of opulence and indulgence. Lucid also has the branding and sales strategy to rival Tesla. Again, this cash balance is unrivaled in the EV space by everyone except Tesla.

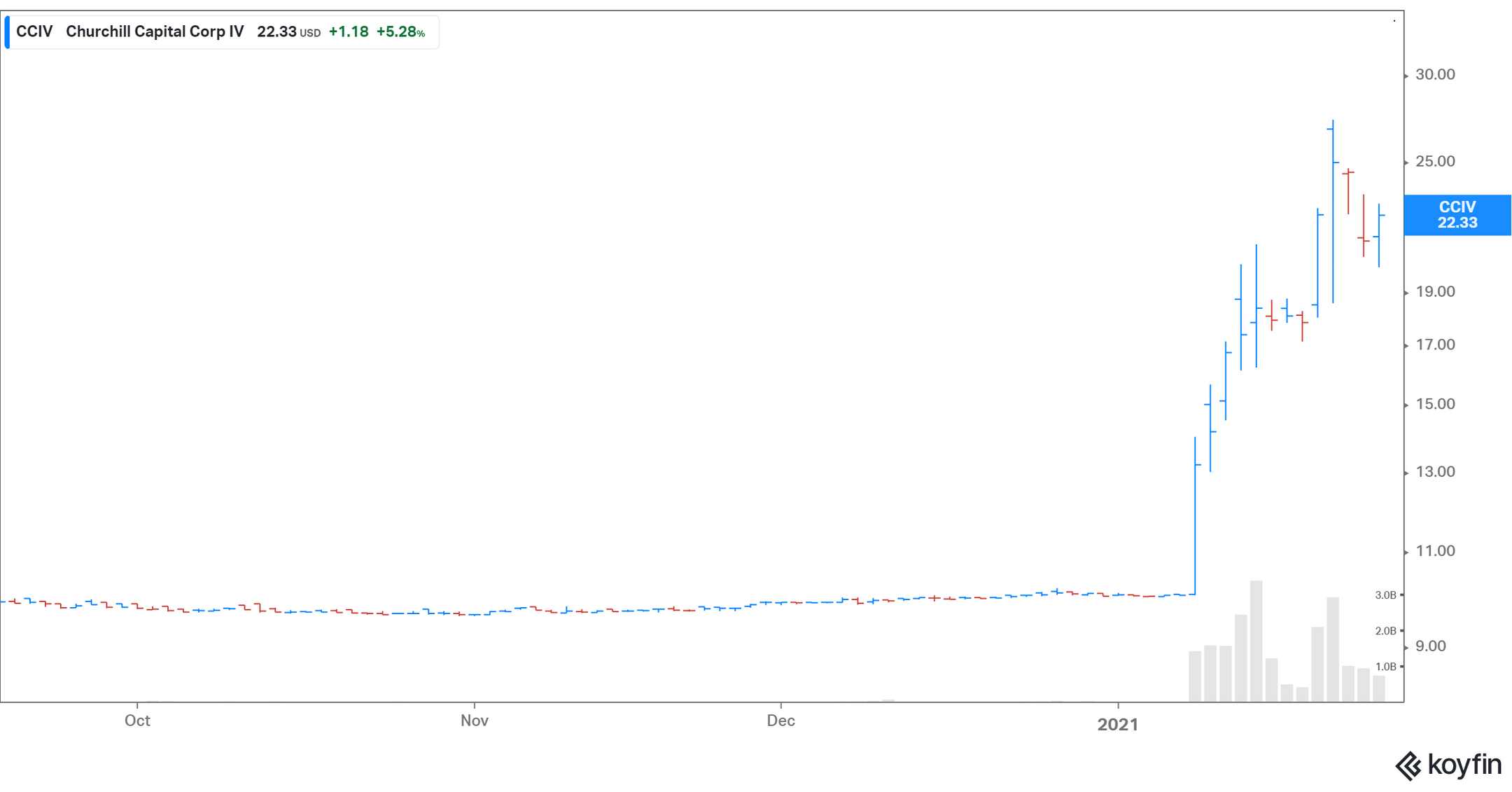

Lucid cciv stock plus#

Lucid Motors also has the resources. Following the closing of the SPAC merger, Lucid Motors is expected to have $4.5 billion plus existing cash on its balance sheet to fund its operations for the next several years. Relative to Tesla, Lucid Motor’s management team stacks up equally (outside of Elon Musk, of course, which – admittedly – is a big difference). This is the most impressive confluence of talent in the EV industry outside of Tesla – and it’s not even close. Supporting him is an impressive team of former Tesla, Audi, Apple (NASDAQ: AAPL), Samsung, Ford (NYSE: F), Intel (NASDAQ: INTC) and General Motors (NYSE: GM) executives. The company is led by Peter Rawlinson, the former Chief Engineer of the Tesla Model S. I’m not exaggerating when I say: “Lucid Motors has it all.” Zooming out, Lucid Motors has everything it takes - and, importantly, is the only company that has everything it takes - to be the “next Tesla.” This, of course, implies big things ahead for CCIV stock.

To that extent, the immediate, gut-reaction sell off in Lucid Motors stock makes sense.īut, the fundamentals here imply that Lucid Motors is actually worth more than $100 billion today, even though the company hasn’t sold a single car yet. Lucid Motors said in a press release that it will, indeed, go public through a merger with Churchill Capital.īut CCIV stock sunk on the news – probably because the merger valued the company at $25 billion, while the CCIV stock price at the time was valuing Lucid Motors at about 4X that, or around $100 billion. From $10 to nearly $70 in a matter of weeks. On those rumors, CCIV stock soared rapidly. There have been murmur for weeks that Lucid Motors would go public via a merger with blank-check company Churchill Capital Corp IV. CCIV Stock: Buy the Rumor, Sell the Newsįirst, let’s talk about how Lucid Motors got here. Instead, zoom out, focus on the big picture, and buy (and hold) Lucid Motors stock for the long haul. So, forget these “buy the rumor, sell the news” dynamics. Long-term, shares could soar to $400 - representing 10X upside potential from the CCIV stock price today. That implies a fair price for CCIV stock of over $60. Given the company’s long-term earnings growth potential, Lucid Motors is worth about $100 billion today.Operationally, Lucid Motors is where Tesla was 10 years ago - and has all the right ingredients and necessary firepower to turn into a major force in the global EV market soon.

We now know that the value of CCIV stock is backed by the fundamental earnings power of Lucid Motors.

This plunge in CCIV stock is a golden buying opportunity, for three big reasons:

0 kommentar(er)

0 kommentar(er)